My brother is an OFW in Saudi Arabia and he pays his maximum SSS contribution quarterly. I was surprised when he sent me a private message on Facebook and asked me if he should continue paying the maximum SSS contribution. When I asked why, he gave me the link to this video from ANC On the Money and he added that he thinks it’s unfair to pay for the maximum amount when what he’s going to receive for his pension is the same as the other members who pay less.

I got confused with what he said so I watched the video first.

ANC On the Money Video: When to Pay the Maximum SSS Contribution

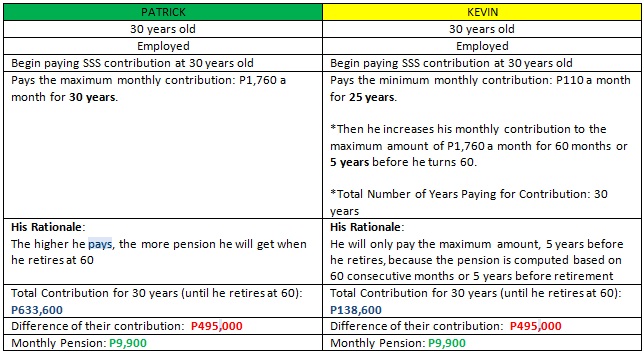

Salve Duplito, ANC On the Money’s resident financial adviser, shared a question that one of their viewers asked regarding this topic. The viewer, named Noel, is currently paying the maximum amount of his SSS contribution voluntarily and he asked if it’s better to pay the minimum amount instead, since the SSS pension plan is computed based on 60 consecutive months or 5 years before retirement. He explained his point of argument using the examples below based on how he understood the process.

Before we discuss this further, let me share with you these resources from ANC On the Money and SSS Philippines website, to know how to compute for SSS Monthly Pension benefit.

ANC On the Money Video: Computation for SSS Monthly Pension Benefit

Computation for Monthly Pension, courtesy of the SSS of the Philippines. (Click the link for the complete details.)

Monthly Pension

- Benefit Computation

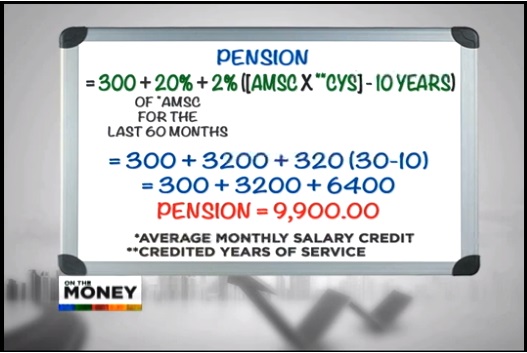

The monthly pension depends on the member’s paid contributions, his credited years of service (CYS), and the number of his dependent minor children that must not exceed five. The monthly pension will be the highest amount resulting from either one of these three pension formulae:

- the sum of P300 plus 20 percent of the average monthly salary credit plus two percent of the average monthly salary credit for each credited year of service (CYS) in excess of ten years; or

- forty (40) percent of the average monthly salary credit; or

- P1,200, if the CYS is at least 10 but less than 20; or P2,400, if the CYS is 20 or more.

Don’t be confused with the computation for the SSS pension plan because it’s different from the computation of the other SSS benefits such as Calamity, Maternity, and Sickness because the latter is based from the actual or most recent contributions.

Going back, here is Salve’s take on the viewer’s question of whether he should pay the maximum contribution or less?

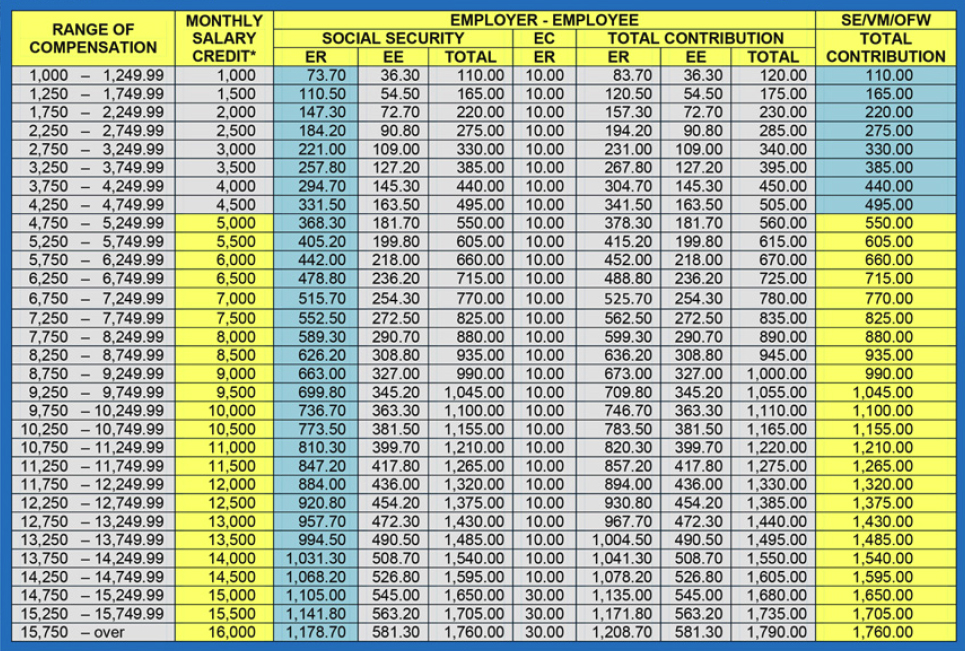

Salve says, “the Social Security System doesn’t allow massive jumps in the contribution rate. The increase has to happen gradually. Thus, you can only increase your contribution a couple of hundreds per year”.

From the example above, it only means that Kevin is NOT ALLOWED to increase his contribution from the minimum amount of P110 to the maximum amount of P1,760 within a given year. Again, the increase has to happen gradually.

Looking at the contribution table above, if Kevin is self-employed or a voluntary member, he can only increase his MSC (Monthly Salary Credit) only once in a given calendar year and by one salary bracket only from the last posted MSC, with some exemptions, which I will share in the next post. So if he is currently paying P110 per month for his SSS contribution, he can only increase it to P165 the next year.

CONCLUSION: For Kevin to be able to pay the highest contribution by age 55 (60 months or 5 years before he retires at 60), he should have increased his contributions gradually starting from age 26.

It is still better to pay the maximum amount of SSS contribution if you can afford it to be able to get the maximum benefits, not only for your Retirement or Pension plan, but also for the other benefits provided by SSS including sickness, maternity, death, and disability.

But let’s not also forget that SSS is not the only option to secure ourselves and our future. We can also consider other instruments like health insurance, life insurance, and Variable Life Insurace (VUL) that offer both health or death benefit and an investment feature. If you are more of an aggressive type of investor, you can also invest in other investment vehicles like the stock market or mutual funds for your future needs. Like what Salve Duplito said, “It is never a good idea to depend on the Social Security System solely for you retirement. As long as the maximum allowable contributions stay low, the benefits they will provide will continue to be insufficient.”

On my next post, I will share with you a very detailed explanation about this topic that was sent by the Social Security System of the Philippines, exclusively for Pinay Investor and to all the readers of this website. Click HERE to read that post.

Sources: Security System of the Philippines, Salve Duplito, ANC on the Money, www.abs-cbnnews.com, and the viewer who raised the question

Disclaimer: I’m not affiliated with the Social Security System of the Philippines. Some of the information here are only based from my own opinion and on how I understood it. If you need a more accurate information of your SSS membership and contributions, please contact SSS directly.

Read Next: Step-by-Step Guide for SSS Loan Application, Requirements, and Payment

Sorry but I still can’t understand I’m still confused with the computation.. So it is true that minimum payers vs. maximum payers have the same pension benefits? Security/ health reasons and etc. in the future will be the benefits if u pay maximum? Tnx

from what i understand,yes,it’s just the same…

Yes, there seems to be no difference but it’s for pension benefits. for other sss benefits, iba ang computations.

No that’s not true, one SSS employee explained that the bigger contribution the bigger pension a retiree will received.

Yes for other benefits.

No for the pension allowance. It is based on one of the calculations mentioned above.

Hi, I think your brother understanding is incorrect, there’s a big difference in pension computation when you contribute the maximum & minimum. I prepared two computation, one (1) computation is the maximum AMSC of Php16,000.00 and AMSC of Php5,000.00. There is a difference of Php6,600.00 when your monthly salary credit is only Php5,000.00.

Thanks for sharing your thoughts.

puwede po bang mg load sa deth pensoin?

Unfair naman para sa naka max contribution kung parehas lang ang pension benefit. Pls post this info in a more simple way. A video can help.

And pls we want the truth directly tell us directly.

ANC On The Money had a similar presentation before regarding this.

Not sure though if it’s still available.

Check this link

https://anc.yahoo.com/video/pay-maximum-sss-contribution-045240290.html

In the past as long as you’ve paid 120 contributions, you will have a monthly pension from SSS. Let’s say you started paying at 21 and stopped at 41, then you have already more than 120 contributions. Like my parents, they stopped working before 60 so they stopped contributing din but they are receiving their monthly pensions. Ganun pa rin ba ngayon? Or dapat dirediretcho ang pagpapayad or at least you won’t missed the last 60 consecutive contributions before you turn 60yrs old? Consecutive means dapat walang palya right? Hope to hear from you soon. Thanks!

Hi Arleni.

I wished I knew the answer but I recommend you contacting SSS na lang directly kasi baka magkamali pa ako ng sagot. 🙂 I’m not an employee of SSS and what I share here are only based from my experience and what you’re asking is something that I’m not capable of answering. Pasensya na 🙂

No, not necessarily continuously. Accumulated yung min na 120 months for pension benefit. Ganun sa pinsan. He stopped working before he reached 60. Pero nung mag 60 na siya, SSS automatically mailed him of his lump sum benefit and his pension is given later computed accordingly.

hi mam,mg inquire lng po,pno po pg iuupdate ko ung monthly contribution ko,sa ngyn po kc dto ko sa abroad,tgal ko npo d nhulugan sss ko,dko rin cgrdo kng member n tlga ko ng sss,pro my id nko kso nwala rin,pls help me mam,thanks

siguro kailangan nyo po muna makipag-ugnayan sa SSS para mabigay nila ung instructions kung pano nyo macocontinue yung contribution payments nyo kasi sabi nyo nga po, mjo matagal na kayong walang hulog at nasa abroad kayo.

Go to any SSS branch, present valid IDs to check if you have already secured an sss number. If you’re already a member, you can always continue paying contributions as OFW, self-eployed or voluntary.

so, what, indeed , is the point of paying the maximum contribution ( for more than 30yrs) if the pension does not differ with those who pay less?

if you pay the maximum, you also get to avail of the maximum SSS benefits like (sickness, disability, maternity for women). the computation of sss benefits are different from each other…

for this post, it’s only for pension benefits.

The higher you pay, the higher the amount you’ll get. Just like investing a certain amount of money, if you invest low then you’ll get low amount in return. Blame economy and blame stock market. While the basis for pension benefit is from the average monthly salary credit, last 5 years of contributions or 1200 if 10 years but not higher than 20 years or 2400 if higher than 20 years contribution whichever is higher will be your monthly pension benefit. The basis for sickness, maternity and loan amount benefit will be from last 12 months or 1 year prior to the amount of application excluding the semester of contingency. For example, if you’ve delivered this january 2016 and will apply for a maternity benefit, they will exclude the semester of contingency from oct. 2015 to march 2016 they’ll get the highest 6 months contributions from Oct. 2014 to Sept. 2015 (12 months) as the basis for maternity benefit. Same with loan 12 months will be considered prior to month of loan application.

i think tama naman po yung explanation na pareho ang makukuhang monthly pensions pero magkakatalo yan sa lump sum money na makukuha just in case gusto mo nang kunin lahat in one time yung contributions mo….

Thanks for sharing your thoughts.

There are 3 computations for the amount of monthly pension benefits. The average of the last 5 years contributions, average monthly salary credit and 1200 if you’ve completed 10 years but not higher than 20 years or 2400 if higher than 20 years, whichever the highest will be the amount of your pension benefit. Saka ka lang qualified for monthly pension kung may at least 120 months or 10 years ka ng hulog. May tinatawag na advance o madalas nilang tawagin na lumpsum kung gusto po ninyong i-advance ang 1st 18 months ng monthly pension mo. At yung isang lumpsum naman po is matatanggap ng mga member na magclaim ng retirement benefit na di nakumpleto ang 10 years or 120 months contributions. parang nai-refund lahat ng contributions mo plus may interest.

ang father ko po hindi nahulugan ng contribution ng company na pinasukan nya for 3 years ngayon lang cla naghulog hiningian ang company ng penalties na umabto ng 300k+ pero ang makukuha lng na lumsum daw ng father ko is 20k+ lahat ng penalties at benefits sa sss lang mapupunta hindi sa naagrabyadong empleyado =/

ohhh, ganun pala un.. 🙁 sorry im not familiar with how it works. sana mas malaki ung nabigay sa father mo…

Ma’am i need ur advice pwede ba mag continue ako monthly contribution ko sa sss tapos na po ako sa ten yrs. contribution I’am now 48yrs. old gusto po ako mag monthly pension (P8,000 plus) . . How much will i contribute monthly?. thank you.

Kasi po 8 years lang po ang nuhulugan sa father po ninyo ma’am. Kung pupunta po sa sss at titignan kung magkano po ang hulog malamang po 100 plus or less than po ang amount per month. unlike ngayon po na pataas na ng pataas ang contribution rating or payment bracket. Kung gusto po ninyo ng mas mataas na pension po dapat po itinuloy at mas taasan pa ang amount po. Parang investment po iyan, kung mag iinvest po kau ng maliit na halaga wag po kayung mag expect ng higher return. pwede pa naman po kasi siyang ituloy, kasi po 65 years old naman po is technical retirement na po.

I just wasted my time reading into a long article when in the end it didnt really asnwer the question. Next time make the article concise, straight to the point, with clear answer to the question in the title.

Hi Gary, Thanks for the feedback.

I ended up this article by saying that to answer the question of what’s the difference between paying the maximum and the minimum Contribution in SSS (or any amount in between), I think part of it depends on our security goals and our capacity to pay.

It’s up to the member kasi if he wants to pay the minimum or maximum kasi he has to assess his/her priorities and capacity to pay. kung pension benefit tlga ang habol nya, then he can pay the maxim 5 years before he retires. kung ung other benefits naman, then as early as now, he can pay the maximum na din.

anyways, kanya2 naman tayo ng pananaw and we have freedom of speech so i respect your opinion. thanks for your comment. God bless!

Hi,

Thanks for the information about the monthly pension plan – most importantly the last five (5) years contribution information.

I have some questions below which I hope you can give some information.

1. Can we downgrade our contributions?

2. Can we withdraw our funds even before retirement?

Thanks.

Hi DZ,

If you’re a self-employed or a voluntary member, i think you can downgrade your contributions.

For the withdrawal of funds, i believe, there’s a certain age that they require.

For more accurate answers to your queries, I suggest you contact SSS directly. Thanks! 🙂

Yes, you can downgrade your contribution it is within your own discretion but it can have effects with the amount of your benefits if you’d wish to file claims or benefits like loan, sickness or maternity. You can only withdraw your contributions in the form of lumpsum if you’ve reached the age of 60. Or even if you’ve completed 120 contributions or 10 years, you still have to wait until you get 60 before you can apply for pension.

And yet I don’t think you did answer the question…

Hi deuts, Thanks for the feedback.

I ended up this article by saying that to answer the question of what’s the difference between paying the maximum and the minimum Contribution in SSS (or any amount in between), I think part of it depends on our security goals and our capacity to pay.

It’s up to the member kasi if he wants to pay the minimum or maximum kasi he has to assess his/her priorities and capacity to pay. kung pension benefit tlga ang habol nya, then he can pay the maxim 5 years before he retires. kung ung other benefits naman, then as early as now, he can pay the maximum na din.

anyways, kanya2 naman tayo ng pananaw and we have freedom of speech so i respect your opinion. thanks for your comment. God bless!

I suggest you gradually increase your contributions till you reach maximum not necessarily maximum contributions allthroughout your 120 months contributions. Try not to pay lower or downgrading your payment from your previous payments thus it can have an effect with your other benefits. There are 3 types of computation for monthly pension the last 5 years of payment, average monthly salary credit or 1200/ 2400 and the highest with these 3 will be your monthly pension.

Hi,

I am an OFW, I been paying the last 2 years of my contribution amounted to 550 but my status in the SSS is voluntary since the last time I was employed in the PH. This month I emailed SSS if I can contribute more than my current contribution which is 550 and told them that I am an OFW but, I didnt receive any reply yet. So, I decided to pay the highest which is 1760 the months of April and May via Metrobank online. After waiting for 3 days, I checked my contributions via SSS online and found out that my last to months contributions has been credited. I already have 66 total contributions now, what is the basis for the pension for my account now? I just want to pay the highest for the remaining months, is it a good idea. Been in stocks, MF, UITF also. Thank you for the clarifications and any more informations.

if you’re after their pension benefits, you may the maximum 5 years before your retirement age. pero if you also want to take advantage of the other SSS benefits (not just the pension), then it’s okay to pay the maximum as early as now as long as it’s within your budget.

ayun,,, nalinawan din aq… Slamat Ms. Janice…

Depends also with your age, if you’re already 55 years old and above you can only increase 1 bracket increase per year. For example, as an OFW and aged 55 you’re paying 550 this year, next year 2017 you can only increase 1 bracket which is 605 (look at the table of schedule of contributions above) and 2018 you can pay 660 until until you reach 60 years. but you you’re 54 years old and above you may opt to choose whatever amount you wish to pay.

I’m also confused. What’s the benefit of paying the max amount? Do we get higher amount of cash assistance in sickness, disability, or untimely death? So if your purpose in contributing SSS is for retirement, it’s better to think like “Kevin” in the illustration, right?

yes, that’s right!

ang computations kasi ng benefits, mostly binibased sa amount ng contributions natin.

Hi, my husband and I are living here in Canada. We make monthly contributions every quarter thru a remittance agency here, my question is, when we retire and eligible for monthly retirement pension, are we supposed to come to the Phillipines and present ourselves as still living? Or, is there some way that we could show a proof of living without going back to the Philippines every year? Because it is so expensive going back and forth to the Philippines from here every year. My other question is do we need to apply for a dual citizenship here in order to get our monthly pensions when we retire? Please let me know. Thanks.

Edna Salazar

Hi Mam Edna,

I wished I knew the answers to your questions, but I’m not affiliated with SSS and I can only suggest that you contact them directly para masagot po nila ng mas accurate yung mga katanungan nyo.

Ito po ung contact details ng SSS

SSS Building East Avenue, Diliman Quezon City, Philippines; Trunkline No. (632) 920-6401

SSS Call Center: 920-6446 to 55; IVRS: 917-7777; SSS Email: me**************@*****ov.ph; SSS Facebook: https://www.facebook.com/SSSPh

Good morning po,pèse ko po bng malaman Kong pano makikita Yung name mo sa sss,kasi dito po Ako ngayun sa abroad pero meron na po akong # ng sss,na wala lang po ng nag bahang ondoy Kaya hindi kuna po alam Ang #ng sss ko kasi gusto ko pong ituloy Ang hulog.

TORONTO, ONTARIO, CANADA

(Call first to make sure the SSS desk is already open)

Philippine Consulate General Office

7th Floor, 160 Eglinton Ave.

East Toronto, Ontario

Canada M4P 3B5

Phone: (416) 922-7181

Fax: (416) 922-2638

Email: General Information & Inquiry

co*************@****************to.com

(Call first to make sure the SSS desk is already open)

Business Hours:

Monday to Friday: 9am to 4pm

3rd Fridays of the Month: 9am to 7pm

Closed on Philippine & Canadian Holidays

SSS email address for OFWs:

of***********@*****ov.ph

Phone nos. for OFWs:

(632) 364-7796

(632) 364-7798

If you need to send documents to SSS through POSTAL Mail:

SSS

International Operations Division

3rd Floor, SSS Building

East Avenue, Diliman

Quezon City

1100 Philippines

sss has set and expanding overseas so members can visit personally and inquire about status and updates.

You will be illegible to any benefit depending on the evaluation from your status, if you’ve been employed before or self-employed and completed at least 120 months or 10 years of contributions. Discrepancies with any of your personal information. You need to have your membership status or data evaluated.

After my father worked as a foreman in an electronic company he decided to pay voluntary minimum contribution to SSS hoping to increase his pension plan/pay when he already reached 60 years old, retirement age. He did this for more than 5 years, not knowing that it is exactly opposite of his goal. My father is now receiving a very small amount in his SSS pension plan. Is there anything we can do about this? I find it very unfair to just base the computation of SSS pension from the last 5 years or 60 months of their monthly contributions. Can we give credit to the bigger amount of monthly contribution of my father when he was previously employed? Where can we apply for recomputation of monthly pension. Thank you.

Hi Ronald,

I feel sad about your father’s situation.

I wished I knew the answers to your questions, but I’m not affiliated with SSS and I can only suggest that you contact them directly para masagot po nila ng mas accurate yung mga katanungan nyo.

Ito po ang contact details ng SSS

SSS Building East Avenue, Diliman Quezon City, Philippines; Trunkline No. (632) 920-6401

SSS Call Center: 920-6446 to 55; IVRS: 917-7777; SSS Email: me**************@*****ov.ph; SSS Facebook: https://www.facebook.com/SSSPh

Paano naman po pag employed? Maximum po ang hinuhulog nila? Pwede po bang sabihin sa HR na minimum lang ang ihuhulog para mas maliit din ang ikakaltas sa sweldo?

I don’t think that would work kasi ang ating contribution technically ay binibased sa salary natin. so if your salary is P15,750-over, then you’re obliged to pay the maximum contribution. (hati kayo ng employer)

Hi Janice. Am 57 yrs old now.this year ng pa member Ako sa sss self employed.am paying. Maximum 1760.ask Lang po Ako how much po Ang maging pension Ko monthly after 10years? Hindi ba Ako lugi nito?

You can always go to the nearest SSS branch in your area have your contributions checked and evaluated. It is also possible to know the approximated monthly pension. They can compute that.

Remember, the SSS pension plan is just one of the many benefits that SSS offers. “Paying the maximum amount of contribution not only will provide us the maximum possible monthly pension plan when we retire, but it also gives us additional security in case something happens to us (sickness, disability, or untimely death).”

Ma’am di ko to gets..based on your table of comparison, it is the same monthly pension plan pa din either how you pay. So how then will we be able to get a monthly pension of more than 9,900?

As far as I know, yan na ang maximum monthly pension, unless nag-increase ulet ng max contribution ang sss for members.

But I may be wrong…

I wished I knew the answers to your questions, but I’m not affiliated with SSS and I can only suggest that you contact them directly para masagot po nila ng mas accurate yung mga katanungan nyo.

Ito po ang contact details ng SSS

SSS Building East Avenue, Diliman Quezon City, Philippines; Trunkline No. (632) 920-6401

SSS Call Center: 920-6446 to 55; IVRS: 917-7777; SSS Email: me**************@*****ov.ph; SSS Facebook: https://www.facebook.com/SSSPh

Came across your article bec of similar question. But just to share I called sss today and they said may memo na pwede na increase ang contribution kahit Hindi gradually. One of the reason why you would also like to pay max is to be eligible for their PESO fund, which is another vehicle for your retirement fund. Kailangan daw Kasi Ng minimum 6 mos before mkapagumpisa Sa PESO fund. At iba pa Ito Sa retirement plan na makukuha ayon Sa contributions mo.

Wow, thank you for sharing this information, Lois!

I appreciate it and it’s good to know about this update. 🙂

Yes, kung nakukulangan ko sa maximum na 1760 contributions may PESO fund option. Para you can pay higher pa than the 1760 max amount. Dapat below 55 years old. Should have 6 consecutive regular sss contributions prior to month of enrollment then nagbabayad ng maximum. 65% will be allocated to retirement/disability benefits.

Walang kwenta naman tong blogger na to di naman pala makasagot ng tama. Palagi nalang refer to SSS and churva! You’re confusing your readers ang you’re giving them false hopes. You’re not even sure of ur article as u just based it on some link. Some more, your conclusion doesnt answer your title heading. You’re asking as to which should be done so (paying the max or min) but you’re not suggesting one at the end of ur article. It frustrates me as I was hoping to get an exact answer.

-anOFWwhoPaysTheMax-

Pingback: From SSS Philippines: Relevant Policies regarding Pension / Retirement Plan | Pinay Investor

How to Check SSS Contributions ONLINE using Mozilla Firefox – Updated July 11, 2015.

https://youtu.be/8aG9HQli99U

My father has existing loan obligation. Will the computation for loan payment STOP once he reached 60?

Your father’s loan will still continue to increase because of penalty, 1% per month. Now, if your father reaches 60 and depending if he was able to complete the 120 months contribution then he will be illegible for monthly pension. He has two options either to claim the advance 18 months of his pension so the sss can deduct his loan balance from it. Or request to receive monthly pension but he cannot obtain it immediately until he can fully paid his loan balance.

Ang gradual increase sa contribution is 1 (one) in a year.. Bawal ang mag jump agad sa mataas.. Anong gagawin ng SSS if naka jump ka sa mas mataas ex. by 3 to 5 level.. kung wala kang idea.? Ang mga teller naman basta lang tanggap ng tanggap ng payment… hindi na na eevaluate.

Hi Len, that is actually a good question. I’ll try to find out what SSS would have to say about that.

Abrupt increase yun, i-didistribute nila sa ibang months yung excess amount.

hi..

i just want to have your opinion.. I have been paying the maximum contribution in the past 7 years. I have now a monthly credit of 16,000. This year will be my 10th year. Can i stop contributing?.. and in the age of 60 do I still have the monthly credit of 16,000 and be eligible for the 40% of monthly credit (which will be 6,400) for the monthly pension?

thanks

Yes po, you can stop if you want kasi it is within your own discretion naman po. Depende po kasi yan sa rate po, sa ngayon po nasa 16,000 monthly salary credit po kayo or 1760 baka for the next couple of years is mag increase nanaman po ang sss ng rates to compensate for the growing benefit claims from members. Then wala na po sa maximum yung monthly salary credit po ninyo.

hi po.ask ko lng if my aunt can still start paying voluntary contribution at her age 58..as in mag start p lng po.d po kc inasikaso ng mga anak nya ako lng po nag try baka pwede pa…tulong ko nlng po sana s knya para at 60 may mkuha xa khit small amout

..pwede p po kaya?

tnx much po

Hi Yhanz,

According to the SSS website (https://www.sss.gov.ph/sss/appmanager/pages.jsp?page=retirementqualifying)

A member is qualified to avail of this benefit if:

Member is 60 years old, separated from employment or ceased to be self-employed, and has paid at least 120 monthly contributions prior to the semester of retirement.

Member is 65 years old, whether employed or not, and has paid at least 120 monthly contributions prior to the semester of retirement.

Hope this helps!

Pwede pa po siyang mag apply ng sss number until 59. Pero sigurado di na po niya maaabot yung 120 months or 10 years to be illegible for pension, lumpsum na po ito. Which is i-rerefund lang po kung magkano po ang total amount ng naihulog plus interest po. Pero pag once nakuha na po ang lumpsum wala na pong ibang benefits like funeral, death, loan, sickness etc. Kasi final claim na po ang pension/retirement claim.

Hi mam ask ko lng po kc my mom wants to be a member po of sss

She is turning 55 na by nov.

Possible pa po ba, she is plain house wife, if yes how much po contribution in a month to avail pension plan in the future

Thanks in advance

Hi Ai,

According to the SSS website (https://www.sss.gov.ph/sss/appmanager/pages.jsp?page=retirementqualifying)

A member is qualified to avail of this benefit if:

Member is 60 years old, separated from employment or ceased to be self-employed, and has paid at least 120 monthly contributions prior to the semester of retirement.

Member is 65 years old, whether employed or not, and has paid at least 120 monthly contributions prior to the semester of retirement.

Hope this helps!

You may also contact SSS directly for your inquiries.

Hi. I am an OFW and paid more than 5 years minimum contribution and 10 years maximum contribution. If I am not interested with other SSS benefits, can I stop paying the contribution and just wait for my retirement age 5 years from now and get the P6,400 monthly pension?

Hi Armand, thanks for sharing this.

Will try to get in touch with SSS and forward your concern to them.

Will let you know once I hear from them.

Maam may monthly pension po b n 15k?

Hi. I already e1- SSS number. I want to register as voluntary. What is the next procedure or form that i need to do? Thank you.

May I know what you want to know specifically?

You can directly pay as voluntary, fill-out the RS-5 form (Contributions payment form) check the voluntary box then after 1 week payment, it will be posted as voluntary payment and as well as your membership status.

Hi, Janice.

Thanks for the information and would appreciate your opinion. I’m an OFW and plan to start contributing again in my SSS.

Please correct my interpretation of the table if I’m wrong.

For an OFW, is the minimum contribution equals to 550 and maximum to 1,760? Can I choose to contribute within that range or opt for the maximum contribution considering my compensation.

Please answer this one. Coz i have the same thoughts as hers. It’l be greatly appreciated!

HOW LONG WOULD YOU WAIT UNTIL MARELEASE ANG PENSION CLAIM ONCE FILED?

1-3 months po. Depende pa po kung may mga for investigations or discrepancies sa po sa member’s personal information.

Hi,

This is informative. My question is, I think I only paid 30mos of max contribution. Then I stopped working. I’m not paying SSS anything upto know. Will I get something? Kahit magkanu? Or nabalewala ung contributions?

Question, if the bank failed to remit the monthly contribution due to system error on their part and past the cut off date . I discovered late after checking my SSS account online. I know retropayment is not allowed.

What can a member do? Should the bank be held liable for making a missed payment for that month? If the bank send a report to SSS, will SSS honor and fill in the missed month? How would that affect the computation of all benefits? I never missed a contribution month until recently. Can SSS shed light on how a gap on contribution affect the pension and other benefits? I appreaciate if there’s a link or any information online. I think other members may experience same situation. Please reply.

My father stopped working at 55.He had been employed and been paying contributions at SSS for about 22 years. When he stopped working, he stopped paying his SSS contributions. Will this mean, he will only receive 2,400 monthly pension once he turns 60 years old? He still got two years before 60, what if he’ll start paying again his SSS contributions, what will his monthly pension be?

Please reply:)

How I continue to pay my sss almost 2year I did not pay.I pay for maximum and my number acct last 9.

Thank you.

Question..ofw po.. naka more than 130mos.napo ang contribution ..lates contribution is 550 pesos. 38yrs old palang..meaning to say..continues parin kaming maghuhulog gang sa ma reach nmin ang 55yrs old then pag 55yrs old napo dun kami mag maximum contribution??

Or pwede na kaming mag maximum contribution then pag naka 5yrs na kami..pwede na kami mag stop??

Same.pa din ba ang pension & benefits nun?

As I understand it, the one bracket increase per year bracket only applies to volunteer members age 55 above. So what happens if you decide to do it ( meaning change the contributions tona maximum) when he turns 54? Will the restriction still apply? Or if more conservative, when you turn 40? Either way you will still end up paying lesser premiums as compared to paying the maximum at the beginning.

Hi all,

Kmsta po,sa mga ndto po n my sapat n kaalaman at karanasan maari po ba magtanong ,

Year 2008 -2011 ay 31 months po ako nhulugan Ng company ko Jan s pilipinas sa halagang 4,500 pesos kada bwan.ang katanungan ko po ay Kung sakali po n itutuloy ko same amount Ng hulog dti ay maari po ba un kht ofw ako at magkano po mgging pension after 120 months ko n mghhulog Kung sakali man n same amount po at more than maximum?Salamat po s inyo

Magkano po pension ko kung saktong 120 maximun unconsistent contribution lang naihulog ko.

i am now 6 months before my retirement, tumaas ang sweldo ko this month qualified to a maximum monthly contributions, ang basis po ba ng computation ng pension ay ang recent salary credit?

i need a reply ty.

Hi, i have a question, my aunt is 57 years old can she apply for sss now as member? and be able to get a pension when she reach 65 years old?