Last week, I received a letter from SSS about this blog post, entitled, “For SSS Pension Plan: Should I pay the Maximum or the Minimum SSS Contribution?”, which I published on March 21, 2015. It was so nice of them to reach out to me to clarify some items and to give me additional info regarding this matter.

But before that, I saw how this post became trending and record-breaking and how it brought my site’s performance to the top. I also received a lot of feedback and comments (both positive and negative) from different people who had the same question and who wanted to know the best answer.

Unfortunately, some of my readers got confused with my take on this question, but I thank all of you for your feedback and questions because it allowed me to research even more and update that blog post with more accurate answers backed by the Social Security System of the Philippines.

I asked them if I can share their letter on this site (www.pinayinvestor.com) and thankfully they approved it. It was addressed to me: Pinay Investor, and it was written by the Vice President of Public Affairs and Special Events Division, Marissu G. Bugante, but the one who emailed me was Ma. Luisa “Louie” Sebastian, Assistant Vice President of the Media Affairs Department, SSS Philippines.

Below are the contents of the letter:

Relevant Policies regarding SSS Pension / Retirement Plan:

- The computation of SSS pensions as provided by the Social Security law is based on a member’s number of contributions as well as the amount of contributions paid. The SSS computes pensions based on the average of all contributions paid by the member from the date of coverage or the average of contributions for the last five years; whichever yields the higher amount is used for the computation.

- The monthly contribution of a member is based on actual compensation for an employed member or the declared earnings for a self-employed/voluntary/OFW member. Changes in the Monthly Salary Credit (MSC) are governed by policies to avoid anti-selection such as undue jacking up of contributions prior to a contingency such as retirement.

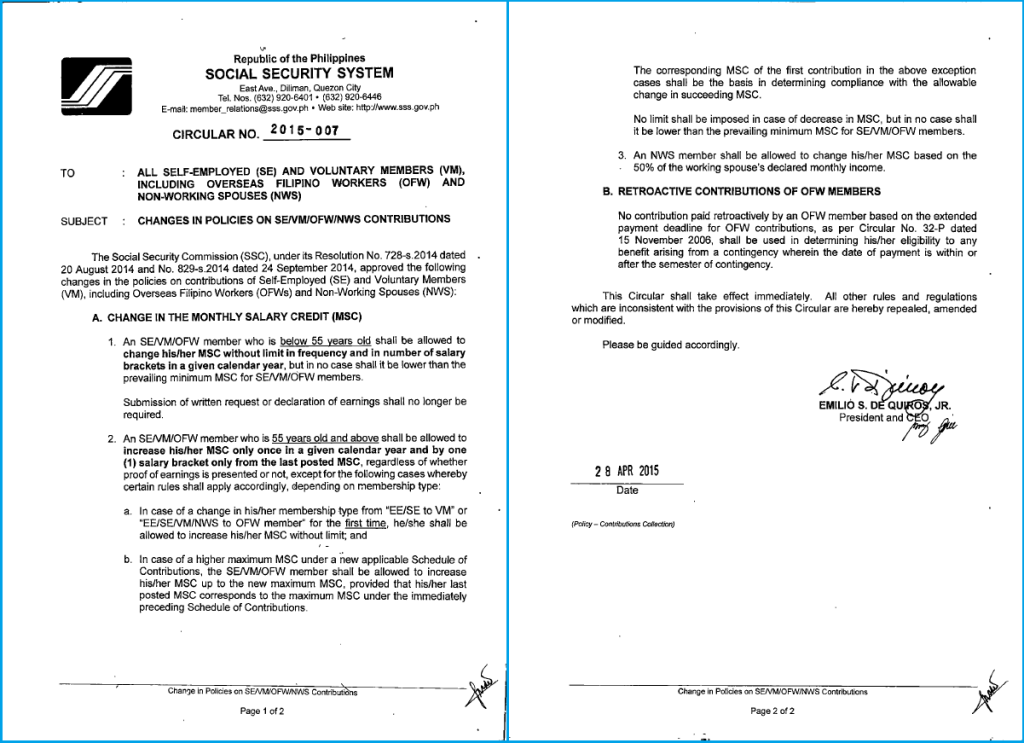

- A self-employed or voluntary member (including an OFW and non-working spouse), who is 55 years old and above, can only increase his/her MSC only once in a given calendar year and by one salary bracket only from the last posted MSC, except if:

- He/she is changing membership type from employed/self-employed to voluntary or OFW for the first time; and

- There is a higher maximum MSC under a new Schedule of Contributions, provided that he/she was paying at the maximum MSC under the immediately preceding Schedule of Contributions. Any change thereafter will be governed by existing rules.

Please refer to the SSS Circular No. 2015-007 (below) which governs changes in policies on SE/VM/OFW/NWS Contributions (Annex A).

- With reference to the illustration you showed in your blog site, since Patrick and Kevin are employed members, the basis of their contributions/MSC is their actual compensation so it is not possible for them to just choose any MSC or change to a higher MSC.

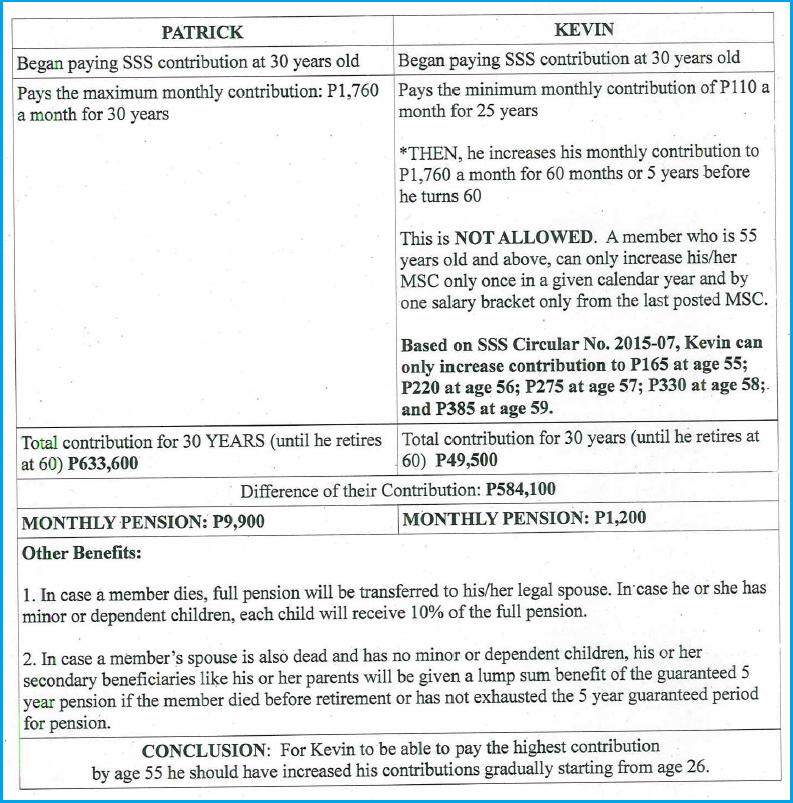

- But if Patrick and Kevin are self-employed or voluntary members, you may refer to the matrix on the next page to illustrate the SSS pension computation of Patrick and Kevin:

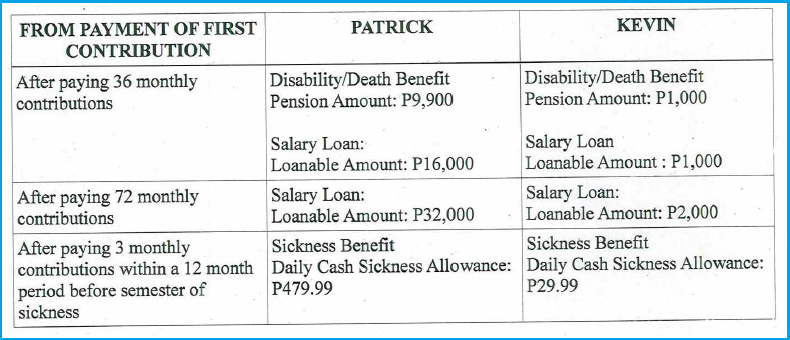

- The example cited above should be analyzed not only in consideration of one’s retirement benefit but also under the whole range of benefits provided by SSS: sickness, maternity, death disability and retirement. Using the given example where both Patrick and Kevin started paying SSS Contributions at the same time, the following are possible scenarios.

Thank you very much Ms. Louie and SSS Philippines for allowing me to post your letter on my website. I’m excited for more of our future partnerships.

And thank you to all my readers for your continued trust and support. I hope you found this information helpful and I hope all your questions and concerns have been addressed by SSS on this post. For other SSS concerns, you may email their Member Relations Department at me**************@*****ov.ph.

You may also send your questions to me privately or through the comment section below and I will try my best to send it to them and hopefully we hear from them as soon as possible.

How long can Patrick receive his monthly pension? 5 yrs? If so, total contributions plus interest can’t be returned to him. Why is this so?

Sa bagong batas nila, bawala na yung dating Teknik sa SSS.

What do you mean?

How long will the pension be given? for 5 years?

until you die then

Upon the death of a retiree pensioner, the primary beneficiaries shall be entitled to 100 percent of the monthly pension, and the dependents to the dependents’ allowance.

How to Check SSS Contributions ONLINE using Mozilla Firefox – Updated July 11, 2015.

https://youtu.be/8aG9HQli99U

I am an OFW… i fee 560 monthly contribution since 2007 when i start working abroad.. Since i read your blog i have intention to raised my monthly contribution to bracket 1k to max. How should i do this? ,just directly fee or I or my wife need to go to SSS office to do the changes of my contribution?.. FYI im turning 40 on oct. and i am Sss member since july 1999.. best regards

Hi Sir,

As stated in Item No. 3, we can only increase our MSC only once in a given calendar year and by one salary bracket only from the last posted MSC, with some exemptions. Please read the exemptions under Item no. 3

Aljo, you can immediately jump to the highest braket without problem if and only if you are below 55 years old… see circular memo 2015-07 item#1

Hi Janice.

Thanks for these helpful info. I just have to consult you though, I went overseas since Oct 2014 and prior to that, I was employed. Now, itutuloy ko na sana yung contri ko but I want to know how much do I pay as an OFW. May hihingin bang docs si SSS if ever I choose to pay this amount, etc? Hope you can help. TIA!

you have to change your status from employed to voluntary or ofw, kailangan mo magpakita ng compensation information para malaman nila kung san ka puwedeng bracket then after a year puwede ka na mag increase ng 1 bracket hanggang sa maximum

Ma’am my mother is contributing as a voluntary member and I am the one who make the contribution. She is turning 57 by October of this year. Since 2 years ago, I gradually increase her contribution by two bracket whenever I can.

This the contibution I made -increasing

Jan-Mar 2014 is P550.00, Apr-Sep 2014 is P605.00, Oct 2014 is P715.00, Nov 2014 is P825.00, Dec 2014 is P935.00

Jan-Jun 2015 is P1,045.00, Jul 2015 is P1,155.00, Aug 2015 is P 1,265.00 and I am planning to increase it monthly by 2 bracket until I reach maximum of P1,760.00.

If according to SSS response to your blog, indicate there that 55yrs old and above can only increase contribution once a year. What will happen to my mothers contribution? What is the best thing I can do with these? I want her to get high amount of pension when she reach her 60. Please advise me. Thank You so much. Hoping for your positive response.

Hi Jennifer, thanks for sharing this.

I’ll try to get in touch with SSS and forward your concern.

Will let you know once they reply.

Pingback: (UPDATED) For SSS Pension Plan: Should I pay the Maximum or the Minimum SSS Contribution? | Pinay Investor

Ask ko ko lang po namatay po ang tatay ko 2005 tapos po nag pension ba daw po siya ng 5yrs kaya po ngayon nagke claim po ako ng death claim sa sss sang sabi po nila wala ba daw po ako make claim. Legitimate na anak po ako at nag iisa po ako. 35 years old na po ako ngayon. Nung nag retired po ang tatay ko 14yrs old pa lang po ako. Help me po pls. Salamat po.

Hi Miss Janice

My husband got a stable job in Saudi this year only. We stopped paying his sss as VM before when his job is not that stable.now we wud like to continue to pay his sss.we are in doubt if we will still pay his sss because he is already 40 yo.iniicp nmin n baka talo pa kmi kung maghuhulog pa kmi ngayon parang late n para maghulog.mga around magkano po kaya ang mgging pension nya kung 40 yo cya mag start maghulog?thanks.

Sa case po ng father ko, dati daw po P84 lng contributions nya. Then nagOFW po sya, for more than 10 yrs maximum binayaran nya. Total of 22 yrs po ang contributions nya. Hndi nman po nmin alam na bawal ang gradual increase ksi pag nagbayad ka sa sss wla nman sila sinasabi basta tanggap lang ng tanggap ng bayad. Nung nagfile sya ng pension 6000+ lng ang monthly pension nya samantalang yung uncle ko 500+ lang ang monthly contributions nya pero nasa 9000+ ang nakukuhang pension. 2 times nmin pinarecompute sa sss, ganun daw po tlga. Kung may reklamo daw po kailangan pa magpunta sa head office. Eh nsa province pa po kmi at senior citizen na ang tatay ko, ayw na ayaw bumibiyahe at pumipila at knowing ang government service natin, for sure pabalik balikin ka lang. Tingin nyo po ba tama ang computations ng pension nya o may mali po. Salamat

Bkit ganon na mas max ang contribution pero maliit ang pension,ngayon I am 45yrs old at self employed ang ssmembership k ,year 2016 fully paid na ak at ang total contribution k umabot n ng 204,last 2004 ang monhly sss contribution k ay 470 pesos at pg 2005 to present maximum payment n ak.kung humindtpo n ak sa pgbbyad ng sss mgkano ang mging pension when I reach 60, on year 2031, or if I will continue paying the maximum until I will 59yrs old how much will be my pension per month?

if kevin is paying 1760 monthly contribution in which ang monthly salary equivalent is 16000, papaano pong nangyaring 9900 lang ang pension makukuha nia?

Hindi ako makapagsend sa****************@*****ov.ph

Hello. Is this still true? Gradual pa din ang pag increase? Or i can go from min 110 to max 1760 in an instant? Parang i read a comment in your other blog post na pwede na yung hindi gradual.

PLEASE REPLY.

Thanks!

Hi!

Ms Janice have a nice day… I am paying sss as volunteer contributor at maximum of 1760 for the last 7 years already, I paid a total of 13 years before wth my employer. I have 160 contributions all in all I am 40 now, what is best? do I have to still contribute at 1760 monthly, what would I benefit If I will pay for 7 years more to make it 20 years paying. Thank you so much.

Hello mam janice ofw po ako gusto kopong mgbyad ng sss saan po pwede mgbyad sss number lang po meron ako ngpa member po ako online at

asawa kopo ofw din ngpamember napo siya kaya lang nlimutan nya number nya plano namin mgbyad kaming dlawa ngayon sunod na buwan anong mga hakbang ang dapat naming gawin ng asawa ko mam kasi nlimutan nya sss number nya, para mkpag bayd napo kami ,ng email napo kami sa me***************@*****ov.ph wala pong sagot gusto kolang po i clarefy para klaro pogusto po namin maximum contribution.slamat po sana masagot nyo po mga katanungan ko sa email kopo. Salmat ng marami