It’s a question whispered in fear across thousands of homes and chat groups:

“Pwede ba akong makulong kung hindi ko mabayaran ang credit card ko?”

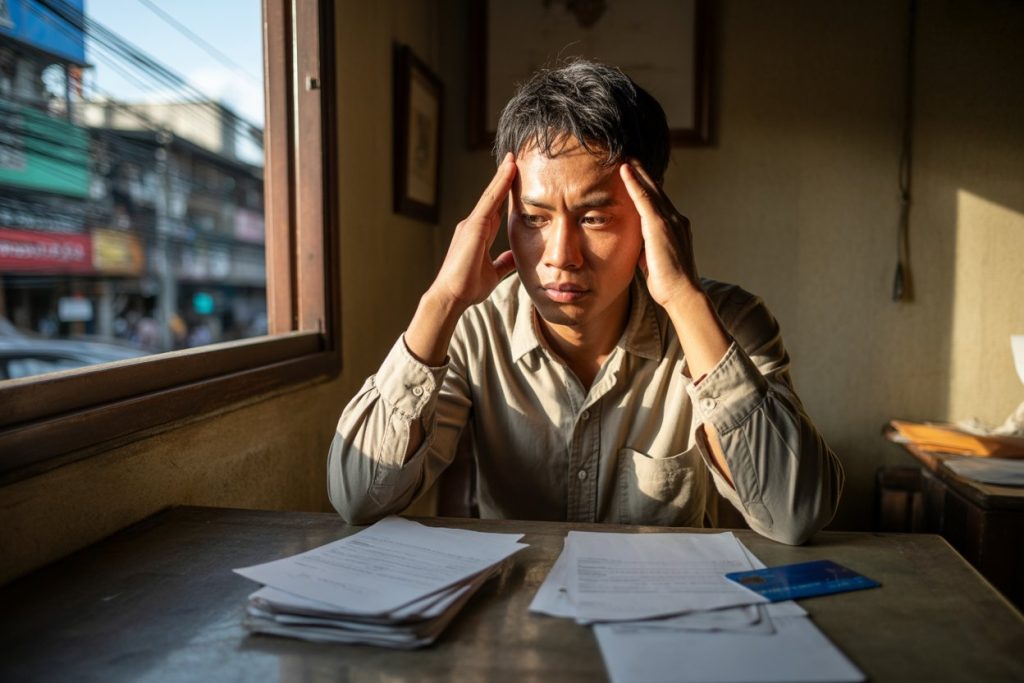

Many Filipinos who fall behind on payments live with this silent worry—afraid to answer unknown numbers, scared to open letters from the bank, and anxious that one day a police officer might show up at their door.

If you’ve been losing sleep over this, take a deep breath. Let’s talk about what the law really says, what can happen if you stop paying, and most importantly, what you can do to protect yourself.

The Short Answer: No, You Cannot Be Jailed for Debt

The 1987 Philippine Constitution is very clear. Article III, Section 20 states:

“No person shall be imprisoned for debt.”

This means you cannot be sent to jail just because you owe money, including credit card debt.

Debt is a civil obligation, not a criminal offense. So missing payments, even for months or years, does not make you a criminal.

But while you can’t be jailed, that doesn’t mean you’re completely safe from consequences. The bank still has the right to collect what you owe, and that can get stressful if not handled properly.

So, What Can Happen If You Don’t Pay?

Here’s what really happens step by step when you stop paying your credit card bills in the Philippines:

1. The Bank Will Start Calling and Sending Notices

After your first or second missed payment, expect reminders by text, email, and phone.

If you still don’t pay, your account may be endorsed to the bank’s internal collections team or a third-party agency.

Collectors might call multiple times a day, and sometimes, even your office or family members.

It can feel embarrassing and stressful, but remember: they are not allowed to harass or threaten you.

You have the right to request written communication only, and to report collectors who violate these limits (we’ll cover this below).

2. The Debt Will Keep Growing

Even if you ignore the calls, the balance doesn’t freeze.

Banks will continue adding interest (up to 3% per month), plus late payment fees and penalties.

For example, if you owe ₱50,000 and skip payments for three months, your balance can easily balloon to over ₱55,000 with fees included.

The longer you avoid it, the harder it becomes to recover.

Read: The Minimum Due Trap: How Banks Keep You Paying Forever

3. The Bank Can File a Civil Case — Not a Criminal One

When reminders and collections fail, a bank may file a civil case for collection. This is a legal way for them to recover what you owe.

If the court rules in their favor, it may allow garnishment of your wages or seizure of assets to pay for the debt.

But that happens after a proper court process, and it still does not involve imprisonment.

You will not be arrested for unpaid credit card debt. You will not have a criminal record for it.

However, a civil case can be time-consuming and emotionally draining, which is why it’s better to act early before it reaches that point.

4. Collection Agencies May Take Over

Banks often outsource old or “charged-off” accounts to third-party collection agencies. These agencies buy the debt at a lower price and try to collect the full amount for profit.

Some do it professionally, but others use scare tactics—threatening jail, lawsuits, or public exposure.

If this happens, stay calm and document everything.

Under BSP Circular No. 454 and CCAP (Credit Card Association of the Philippines) guidelines, debt collectors are prohibited from:

-

Threatening you with arrest or legal charges

-

Calling before 6 a.m. or after 10 p.m.

-

Harassing you or your family

-

Posting your debt publicly or on social media

If they cross the line, report them to the Bangko Sentral ng Pilipinas Consumer Affairs Office or CCAP at www.ccap.net.ph.

You have rights. Use them.

Why People Think They Can Go to Jail

The confusion usually comes from harassment and misinformation.

Some collectors pretend to be from law offices or government agencies. They might use words like “subpoena,” “warrant,” or “final notice before legal action.”

These are scare tactics. Unless you receive an official document from a real court with a case number and seal, it’s not a legal order.

Remember, collectors get paid when you pay. Some of them lie or exaggerate to pressure you into immediate payment.

Knowledge is your best defense.

Read: What Happens If You Stop Paying Your Credit Card Debt in the Philippines?

But What If I Issued a Check?

There’s one common situation where jail can be possible, but it’s not about credit cards themselves.

If you issued a bounced check (covered by the Bouncing Checks Law, Batas Pambansa Blg. 22), that’s a separate criminal offense.

So if your debt payment bounced because you used a check that didn’t clear, you can face legal penalties — but it’s for the act of issuing a bad check, not for the debt itself.

If you’re using postdated checks for loan payments, always make sure your account has enough funds to avoid this problem.

How to Protect Yourself (and Your Peace of Mind)

If you’ve fallen behind or already stopped paying, here’s what you can do today:

1. Talk to Your Bank Early

Call them before they call you endlessly. Ask about balance conversion, installment plans, or debt restructuring options. Banks often prefer cooperation over litigation.

2. Don’t Run Away from the Problem

Avoidance only makes the interest grow. Start with small payments if that’s all you can manage. Consistency matters more than perfection.

3. Organize Your Debt

Use my Free Debt Inventory Tracker to list down all your cards, balances, interest rates, and due dates.

Seeing the whole picture helps you plan better and lowers the emotional burden.

4. Document and Report Abusive Collectors

Keep screenshots, call logs, and messages. If they violate the rules, report them to the BSP or CCAP.

You can also block numbers and request communication through email only.

5. Educate Yourself and Plan Your Escape

The more you know, the less fear has power over you.

My ebook Break Free: Your Ultimate Guide to Escaping Credit Card Debt for Good walks you through 13 practical strategies — from choosing the best payoff method to talking to banks with confidence.

It’s Not About Jail — It’s About Taking Back Control

Credit card debt isn’t a crime, but it can steal your peace if you let it.

The real punishment is not prison—it’s the constant anxiety, the sleepless nights, and the guilt of avoiding calls.

You deserve better than that.

Start where you are. Pay what you can. Ask for help when needed.

You can recover from this, one payment and one plan at a time.

Final Thoughts

So no, you won’t be jailed for credit card debt in the Philippines. But you’ll stay emotionally imprisoned if you let fear and avoidance take over.

Freedom begins with clarity, and you have that now.

Next, take action.

-

Download your Free Debt Inventory Tracker to see your full financial picture.

-

Read Break Free: Your Ultimate Guide to Escaping Credit Card Debt for Good to learn exactly how to get out of debt — safely, legally, and confidently.

You can’t change the past, but you can rewrite your next chapter.

And it starts the moment you stop hiding and start choosing freedom.