Managing your finances shouldn’t feel like a full-time job. But when you’ve got multiple bank accounts, credit cards, and investment portfolios scattered across different platforms, keeping track of everything can quickly become overwhelming.

Logging in to different accounts, remembering multiple passwords, and manually organizing your spending can feel like a tedious chore.

Wouldn’t it be easier if you could see all of your financial data in one place, organized and ready for you to analyze?

That’s where Dobin steps in. Dobin is the personal finance app that brings all your financial information together—effortlessly.

With Dobin, you get a clear, consolidated view of your financial health in real time, across multiple accounts, without the headache of switching between different apps.

But, like most of us would ask when we hear about new financial tools: Is it safe?

Read on to learn more about Dobin’s key features and how it can simplify your financial management—while keeping your data safe and secure.

Why Dobin is a Game Changer for Your Financial Management

Managing your money is already hard enough without having to hop between five different banking apps just to keep tabs on your accounts.

Whether you’re tracking your expenses, checking balances, or staying on top of multiple credit cards, Dobin takes the hassle out of money management.

It automatically gathers your financial data from all your connected accounts into one clean, organized dashboard.

Here’s what makes Dobin so essential:

- No More Manual Tracking

Forget about manually logging your expenses into spreadsheets. Dobin automatically tracks, categorizes, and analyzes all your transactions using AI-powered tools, helping you understand where your money is going each month.

- One App for All Accounts

Whether you have multiple credit cards, a checking account, savings accounts, or pay-wallets, you can see everything in one place with Dobin. No need to juggle between apps and websites anymore.

- Identify Hidden Fees

Ever get hit with unexpected charges? Dobin gives you a detailed view of all fees and recurring subscriptions that are draining your account. You’ll see where those hidden service charges or surprise overdraft fees are lurking, giving you a chance to cut them out.

- Maximize Credit Card Rewards

If you’re trying to juggle multiple credit cards to optimize your rewards points, Dobin helps you stay on top of your rewards balances and when to switch spending to different cards for the best results. No more missed rewards or surprise over-limit charges!

But Is Dobin Safe?

When it comes to financial apps, security is always top of mind—and it should be.

After all, your personal and financial data is incredibly sensitive.

But rest assured, Dobin puts your security first with industry-leading protocols designed to protect your data every step of the way.

Here’s how Dobin keeps your information safe:

1. Bank-Level Encryption

Dobin uses 256-bit encryption—the same kind that top financial institutions use—to ensure your data is transmitted securely. This means your information is unreadable to hackers and unauthorized users trying to intercept your data.

2. Multi-Factor Authentication (MFA)

Passwords alone aren’t enough to secure your accounts, which is why Dobin requires MFA if it is enabled on your online banking account. This means that even if someone gets your password, they can’t access your account without a second verification method, like a one-time passcode sent to your phone.

3. Secure Data Storage

Your data isn’t just encrypted during transmission; it’s also securely stored. Dobin uses advanced storage technologies to ensure that only authorized personnel have access to the servers holding your financial information.

Dobin does not store your bank login details on their servers. They are securely stored on your phone (on the Apple Keychain or the Android Keystore).

4. Regular Security Reviews

Dobin continuously evaluates its security measures. This proactive approach ensures they stay ahead of any potential threats, keeping your data safe.

5. Data Anonymization

Even when Dobin uses your financial data for analytics with your explicit consent, they anonymize it, ensuring that your identity is never tied to the insights derived from your information. Your privacy is always Dobin’s top priority.

Understanding Your Financial Health

![]()

You might find yourself asking questions like,

“Am I saving enough?” or

“How will my spending affect my ability to get a loan?”

These uncertainties can create stress and confusion, especially when it comes time to make important financial decisions, such as applying for a credit card or a loan.

As a financial planner, I see this struggle all too often.

Many individuals lack a clear, consolidated view of their overall financial well-being.

Without this insight, gauging your readiness for big financial commitments can be challenging.

It’s easy to overlook areas that might need adjustment, leading to missed opportunities or, worse, financial pitfalls.

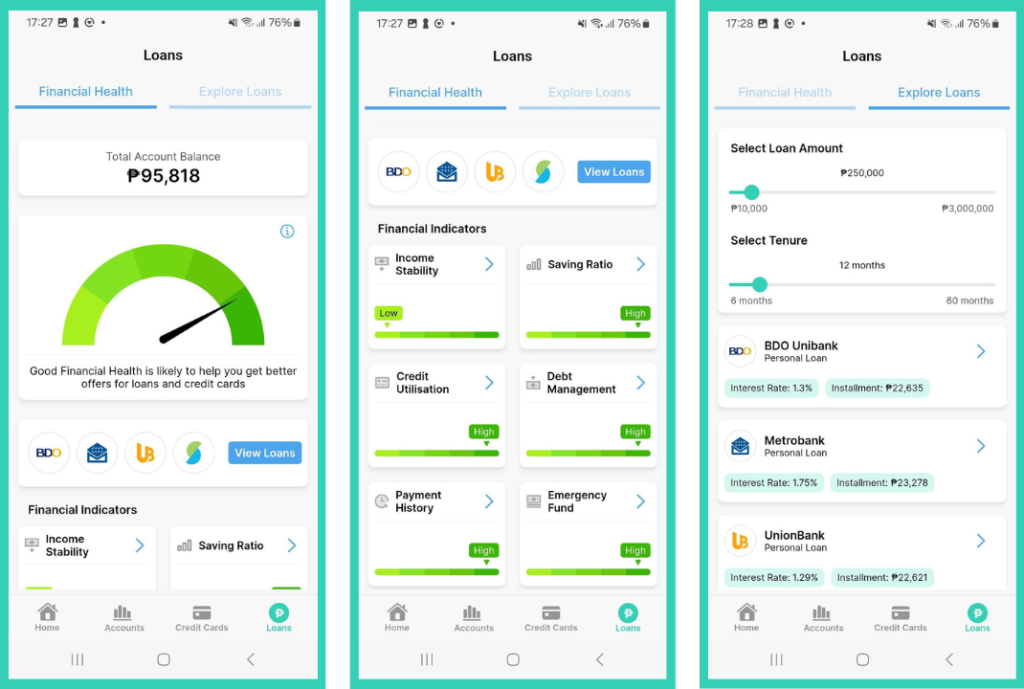

The Role of Dobin’s Financial Health Indicator

Imagine having a personal financial coach right on your phone, guiding you through with clarity and confidence.

That’s essentially what Dobin offers with its Financial Health Indicator.

Your Financial Snapshot

With this tool, you receive a comprehensive summary of your financial health.

It gives you a clear view of your income stability, savings ratio, credit utilization, debt management, payment history, and even your emergency fund.

It’s like having your financial picture framed and hanging on your wall—clear, straightforward, and easy to understand.

Making Informed Decisions

Having this wealth of information at your fingertips means you can finally understand how different aspects of your finances interact.

For instance, if you’re curious about whether your current spending habits might impact your chances of securing a loan, Dobin lays it all out for you.

This transparency enables you to make informed decisions with confidence, rather than guessing or feeling overwhelmed.

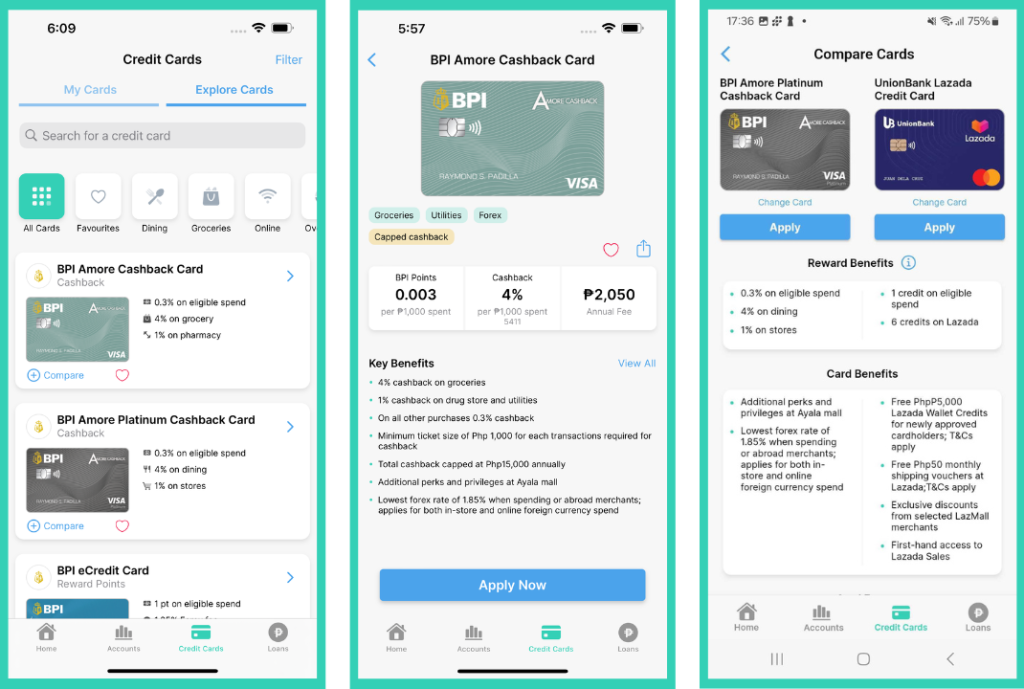

Find the Right Credit Card

If you’re looking for the best credit card, Dobin’s ‘Explore Cards’ feature makes it easy to find the right one for your needs. With just a few clicks, you can compare credit cards, review key benefits, and see terms and conditions all in one place. Whether you’re looking for the best rewards, travel perks, or low-interest rates, Dobin’s tool helps you make an informed decision without the hassle of visiting multiple websites.

Having tried Dobin myself, I can honestly say it’s been quite helpful so far. The interface is user-friendly, and everything is well-organized, making it easy for me to view all my card options clearly.

Find the Right Loan

If you’re considering applying for a loan, Dobin’s ‘Explore Loan’ feature simplifies the entire process. You can easily check potential interest rates and installment plans based on your desired loan amount and tenure. This empowers you to choose the loan that fits your financial situation, freeing you from the pressure of settling for options that don’t align with your goals.

What I appreciate most about Dobin is its financial health visibility. With all my expenses and categories clearly laid out, I can make informed decisions faster. Dobin complements my financial planning by providing a consolidated view that saves time and helps me stay on top of my financial goals.

What About Concerns Because Dobin is New?

It’s understandable to feel cautious when trying out a new app—especially one that deals with something as personal as your finances. While Dobin is new in the Philippines, it’s actually well known and widely adopted in Singapore, and is even viewed by some as the best financial app in the country.

If you’re skeptical about whether Dobin is the right fit, you’re not alone. Many people have concerns when it comes to trusting a new financial platform.

You might wonder:

Is this app secure?

How does it handle my data?

Here’s what you need to know:

- Transparency: Dobin takes pride in being fully transparent about how it handles and protects your financial information. From encryption to secure storage, Dobin lays out every measure it takes to safeguard your data. But don’t just take our word for it—explore Dobin’s privacy policies, reviews, and independent security audits to see for yourself.

- Data Ownership: When you use Dobin, you remain in full control of your data. The app simply acts as a tool to help you organize and understand your financial health. Dobin won’t sell your data to third parties, and all insights generated from your information remain anonymized to ensure your privacy.

- Do Your Due Diligence: It’s always smart to do a little research before committing to any financial product. While Dobin is a safe, secure, and valuable tool for many users, it’s important that you feel confident in your choice. We encourage you to explore reviews, ask questions, and make sure the app fits your specific needs.

If you’re still unsure, try Dobin with one or two accounts first. See how it works for you and build trust over time.

How Dobin Will Change the Way You Manage Money

Instead of logging into four different apps to check your balances and analyze your spending, you simply open Dobin.

In an instant, you see everything you need—your bank account balance, your recent transactions, your credit card rewards, and even a snapshot of your financial health, all in one easy-to-read dashboard.

Dobin takes the guesswork out of money management. Whether you’re looking to reduce debt, optimize your credit card rewards, or track your monthly spending, Dobin gives you a full financial picture with a single tap.

And remember—it’s completely free to download and connect your accounts. No premium subscriptions, no hidden fees—just a smarter, more efficient way to manage your money.

Is Dobin Really Free? How Does It Make Money?

Now, you might be wondering,

“If Dobin is free, how do they make money?”

It’s a great question!

Part of Dobin’s model includes a section that offers credit card applications and loans through their partner companies.

This means that while you enjoy all the fantastic features of the app at no cost, Dobin earns a referral fee whenever a user applies for a credit card or loan through the app.

This model allows Dobin to provide valuable services to users without charging any fees, all while helping you find the best financial products that suit your needs.

So, you can explore your options and enjoy the benefits of a comprehensive financial management tool—all without spending a dime.

Final Thoughts

If managing your finances has been a source of stress, it may be time to explore a fresh approach. With bills, credit card payments, and daily expenses piling up, it’s easy to feel overwhelmed.

However, with Dobin, you can take back that control. With its user-friendly interface, automatic categorization, and robust security features, Dobin is the personal finance app you never knew you needed—but won’t be able to live without once you try it.

So why wait? Give Dobin a shot and see how it can transform the way you manage your finances. You may find just what you need to feel more in control! Click here to download the Dobin app.

In the end, my goal is to help you feel empowered in your financial journey. Tools like Dobin are designed to make managing your finances easier, but the choice to move forward is always yours.