Originally published: March 29, 2015

Attending the Financial Fitness Forum 2015 was an absolute privilege. It was an incredible opportunity to be in the presence of some of my personal finance idols, all gathered in one venue to share their expertise and inspire attendees.

My primary reason for being there was to co-promote the upcoming Stock Smarts Workshops by Marvin Germo, in partnership with Manila Workshops, and to assist with the registration process for those interested in the April 2015 run.

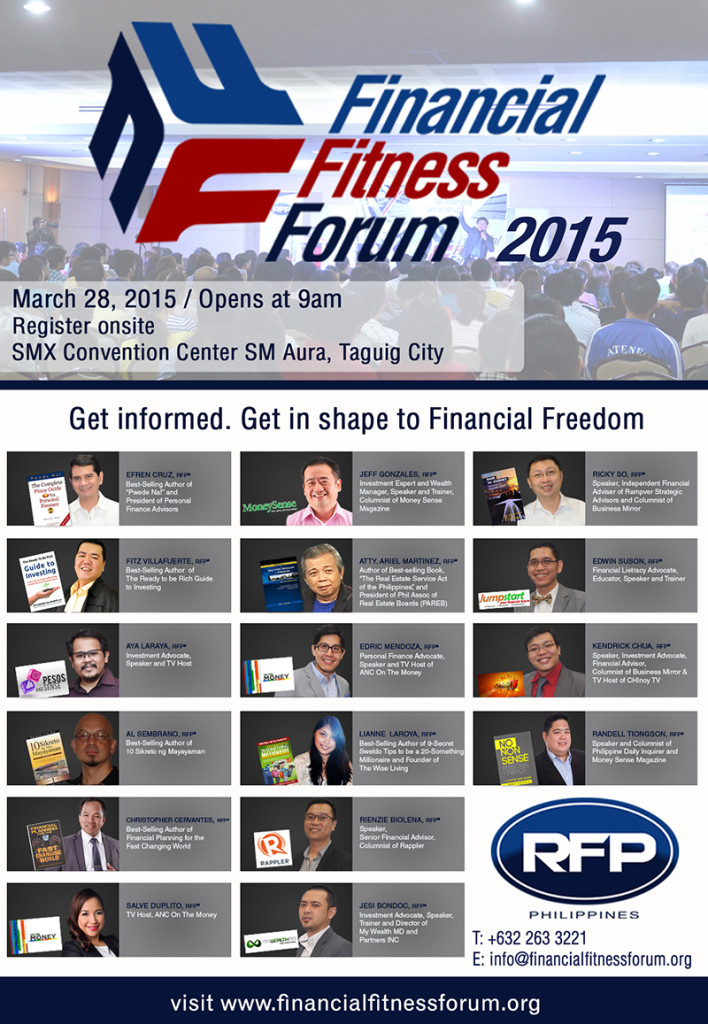

For those unfamiliar, the Financial Fitness Forum or FFF is a premier one-day personal finance event featuring top luminaries from the Registered Financial Planner Institute of the Philippines (RFPI Philippines).

This year’s forum was led by Mr. Henry Ong, also known as the “Father of RFPI Philippines.” His presence throughout the event ensured that everything ran smoothly—and it did!

The entire program was well-organized, with speakers keeping to their allotted time, making for an efficient and insightful day.

A Stellar Lineup of Speakers

This was my first time attending the Financial Fitness Forum, and I must say, the lineup of speakers was nothing short of outstanding.

Each session was filled with valuable insights that left the audience inspired and eager to take action on their financial goals.

Here are some of my key takeaways from the event:

Efren Cruz – “Where Does All My Money Go?”

Efren Cruz is a household name in personal finance, admired by many (myself included) for his expertise in money management.

His session was packed with practical financial tips, but what made it even more memorable was his talent. He sang and played the guitar, adding a personal touch to his talk.

I managed to take a photo with him, though I later realized it was blurry—so I’ll have to wait for another chance next time!

Edric Mendoza – “How to Create Your Own Education Plan”

Edric Mendoza, known for hosting ANC’s On the Money, spoke about the importance of planning for children’s education.

As a homeschooling father of five, he shared how much he and his wife save by not sending their kids to exclusive schools, emphasizing the value of quality time spent learning together.

His son, Elijah, also took the stage, impressing the audience with his eloquence and intelligence.

Edric introduced the DIY approach to education planning:

- D – Do your research.

- I – (I must admit, I forgot what this stands for! If anyone remembers, please comment below. 😊)

- Y – Why? (Understanding the purpose behind financial decisions.)

Aya Laraya – “The Mirage of Long-Term Investing”

Aya Laraya highlighted the importance of setting clear investment goals.

He challenged the conventional distinction between short-term and long-term investing, emphasizing the need to remain flexible in adapting to financial circumstances.

Marvin Germo – “Winning Strategies for Investing in the Stock Market”

As someone who has collaborated with Marvin on multiple seminars, I always look forward to his talks.

Despite having heard him speak numerous times, I still learn something new each session.

One of his key takeaways from this forum:

“Nobody can predict the stock market—not even experts—but with the right strategies, you can increase your chances of success.”

Randell Tiongson – RFP Video Presentation & Announcements

Randell, who also co-hosted the event, shared his experiences as a personal finance advocate and introduced the Registered Financial Planner (RFP) Program.

To my surprise, he mentioned that I looked familiar—maybe he’d come across my blog! 😊

Christopher Cervantes – “How to Build Your Wealth Towards Financial Independence”

A seafarer and a Registered Financial Planner, Christopher Cervantes spoke about the financial struggles of OFWs, particularly the tendency to overspend on pasalubong (gifts for loved ones).

He shared how financial education transformed his money mindset and allowed him to help fellow seafarers achieve financial stability.

Salve Duplito – “How to Master the Art of Managing Your Finances”

Salve’s story is always inspiring. Despite coming from a humble background, she never felt poor because of the love and support of her family. Her message resonated deeply:

“Don’t let your financial status define you. Strive for the best and let your actions shape your future.”

Jeff Gonzales – “How to Create Your Own Mutual Fund”

Unfortunately, I missed this talk as I had to step out to charge my laptop. However, the topic itself suggests a discussion on diversification—spreading investments across different assets to minimize risk.

Fitz Villafuerte – “How to Invest Effectively to Achieve Your Financial Goals”

Fitz is one of the most influential finance bloggers in the country, known for tirelessly sharing knowledge about investing.

Having worked with him on a project earlier this year, I’ve seen firsthand how much people trust his expertise.

Lianne Laroya – “9 Secret Sweldo Tips to Become a Millionaire”

Lianne, at just 23 years old, is a passionate advocate for financial literacy, particularly among young professionals.

Her book is filled with valuable lessons, and I admire her mission to educate fellow twenty-somethings on smart money habits.

Kendrick Chua – “Think Intsik: Money Habits of the Chinese”

Kendrick shared his family’s journey from humble beginnings to financial success.

He emphasized the power of delayed gratification, frugality, and defining clear financial priorities—habits that have helped many in the Chinese community build wealth.

Panel Discussion – “Do You Really Need a Financial Planner?”

Panelists Jesi Bondoc and Edwin Suson discussed the value of consulting a financial planner.

The consensus? Regardless of your income level, everyone can benefit from financial planning.

Many people aspire to a comfortable financial future but fail to take the necessary steps to plan for it.

As an advocate for financial education, I’m glad to see more individuals pursuing the RFP Program. I had considered enrolling last year but encountered scheduling conflicts. Hopefully, I’ll be able to take it soon!

Update: In 2021, I finally took the leap and enrolled in the RFP Program. After successfully completing all the requirements, I officially became a Registered Financial Planner in February 2023.

Read my RFP Journey here: My Journey to Becoming a Registered Financial Planner

Rienzie Biolena – Closing Remarks

Though I missed Rienzie’s closing remarks due to assisting with Stock Smarts registrations, I later read up on him.

Like the other speakers, he is a dedicated financial literacy advocate who regularly contributes to Rappler and Moneysense, emphasizing the importance of investing in oneself—whether through seminars, books, or personal finance programs.

Final Thoughts

It was a long but fulfilling day at the Financial Fitness Forum 2015. I walked away with valuable lessons, fresh insights, and renewed motivation to continue my journey in financial education.

I’m already looking forward to the next Financial Fitness Forum in 2016!

How about you? Did you attend #FFF2015? What were your key takeaways? I’d love to hear your thoughts in the comments below!

Thank you for coming, Janice. Too bad we weren’t able to take a picture!

Hi Lianne! I’m surprised to see you here! Thanks for dropping by! 🙂

Yeah, I wished we had a photo taken together. Actually I saw you at the FFF event but I was busy entertaining inquiries and registration that time that’s why I wasn’t able to approach you. Next time ulet! 😉

Galing naman.

I like attending this kind of events. It is nice actually to be meet people who share the same goals and desires as you have.

Cheers

Thanks! I hope to see you soon in some financial events! 🙂

I also wanted to attend financial fitness of other seminars like these. I just hope, just like you pinayinvestor, I will be a certified WAHM. I still need to keep my dayjob and I am writing part time. Medyo di pa kaya mag shift sa full time writing para mas madami time umattend ng seminars. Thanks kasi I was able to catch up parang andun na din ako dahil sa posts mo. Good job.

Pingback: iCon 2015 Investment Conference – An Empowering Experience! | Pinay Investor

Pingback: My Bucket List | Pinay Investor